‘Fitting targets generate greater gains in synergy’

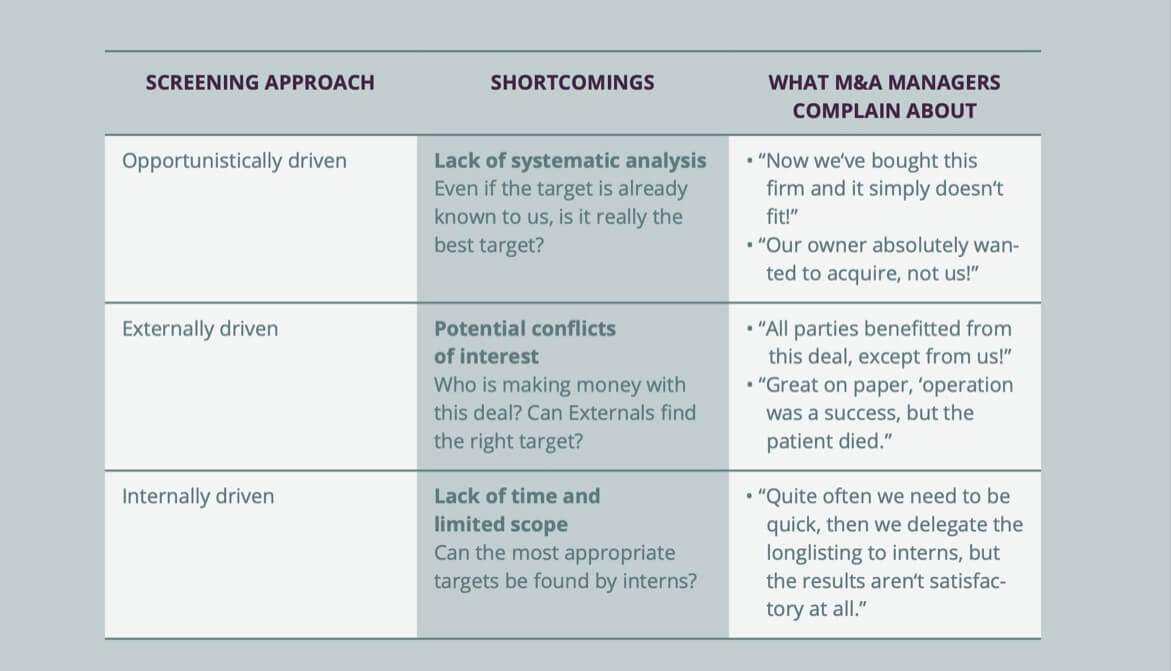

Despite its critical importance in M&A, target screening has received less managerial and scholarly attention than practices of financial valuation and integration. Simply put, target screening matters! Textbook versions of an “ideal” target screening process are usually very different from the reality. What is tought in university involves the systematic, transparent reduction of comprehensive long- lists into shortlists, but management practice provides a different picture. Three most common approaches to screening (i.e., opportunistically driven, externally driven, and internally driven) provide managers with not only specific advantages but also severe inherent disadvantages.

In this white paper, we explain the cognitive biases to be aware of when screening in traditional manners for acquisition targets. M&A teams that understand the mechanisms of these biases can screen more effectively.

Moreover, we outline how the MADiscover technology works based on systematic, comprehensive, and consistent data analysis. We use both a more strategic approach of target screening and AI-based technology for creating actionable shortlists.